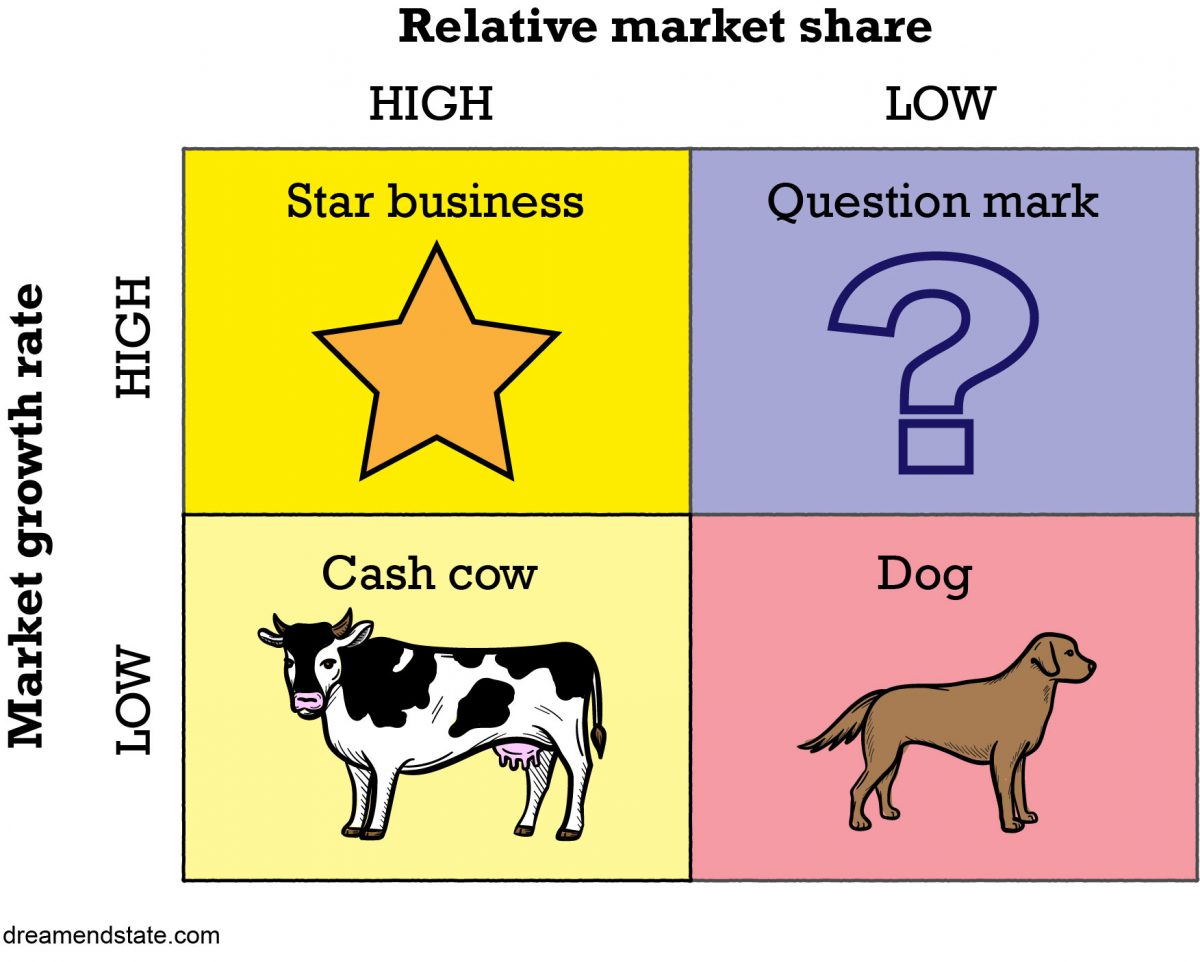

Here’s a model for categorizing which businesses to invest in, start, nurture, attempt to turnaround, wind down or sell.

Created by Bruce Henderson for the Boston Consulting Group, the BCG growth-share matrix or the Star principle is a lens through which businesses can focus their activities. It can also be used as a template for investing (particularly in start-ups and young companies), as a guide for prospective employees looking to join a start-up, or as a north star for would-be entrepreneurs.

In summary:

- Star businesses are what everyone is after: a business or product that is growing fast with a high market share. Stars usually require cash to grow.

- Cash cows are businesses with high market share and slow growth. As the name suggests, they generate lots of cash in excess of the reinvestment required to maintain market share.

- Question marks are characterized by low market share and high growth. They usually require more cash than they can generate.

- Dogs are low growth, low market share businesses. Get out and cut your losses.

Watch out for

Be careful not to apply the model too simplistically. “Cash cows” still need investment to maintain market share – they can’t be milked indefinitely.

Henderson said that companies need a portfolio of products to “truly capitalize on its growth opportunities.” Cash cows help fund star businesses. Dogs should be avoided. Question marks can be converted to stars with added funds or cut.

Remember all products (and businesses) have a lifecycle. Stars eventually become cash cows as growth slows or they get overtaken by rivals and become question marks and dogs. Henderson said: “The value of a product is completely dependent upon obtaining a leading share of its market before the growth slows.”

Richard Koch, in his book The Star Principle, applies stricter criteria to his concept of a star business. In his version, the star must be the market leader in its niche and the market niche must be capable of growing at least 10 percent a year, on average, over the next five years.

The star of the portfolio is a rare and wonderful thing: its value is also rarely recognised and, typically, it’s strategically mismanaged.

Bruce D. Henderson

Resources

Henderson, B. (1970). The Product Portfolio. BCG

Koch, R. (2008). The Star Principle. Piatkus

Koch, R., Ferriss, T. (September 2020). Richard Koch on Mastering the 80/20 Principle. Podcast