Pulverize your competitors with this tool to analyze the environment that shapes your organization’s performance.

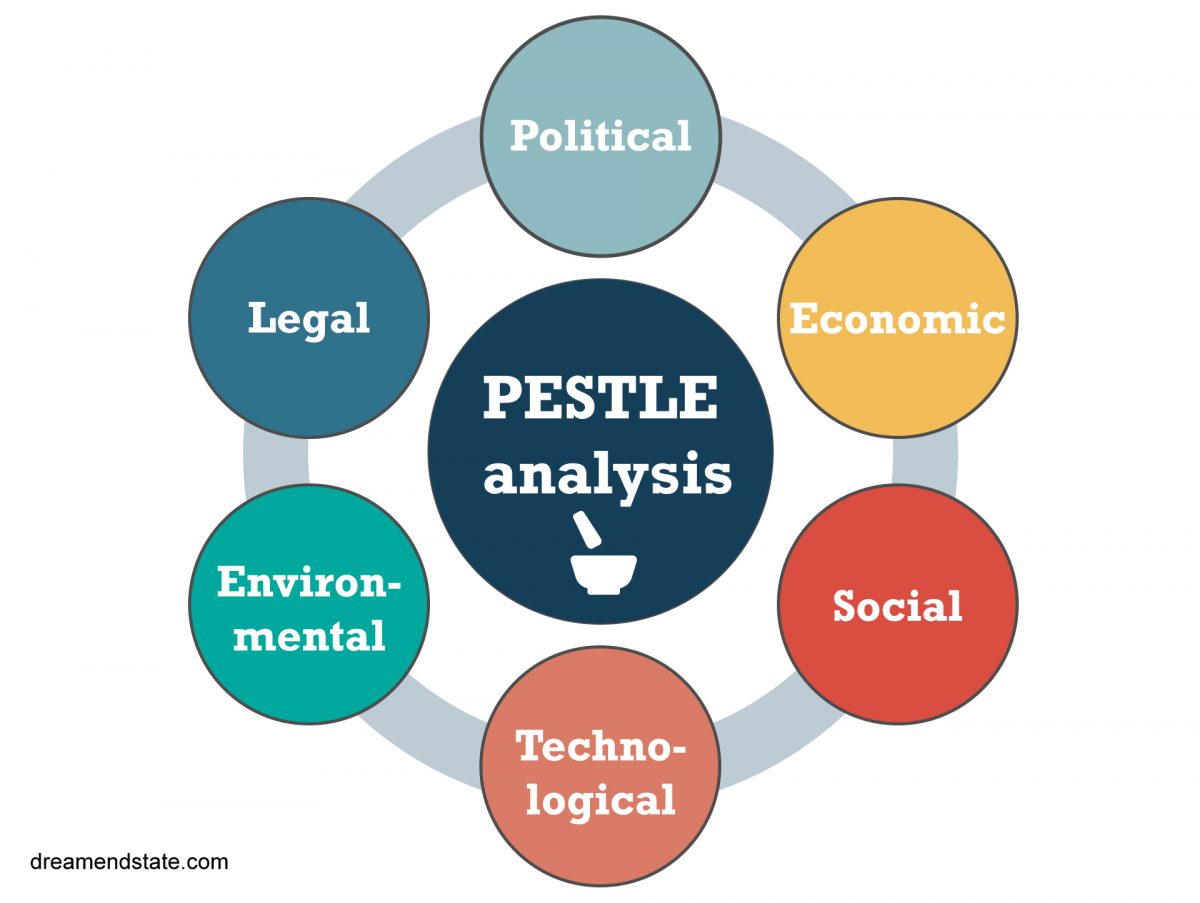

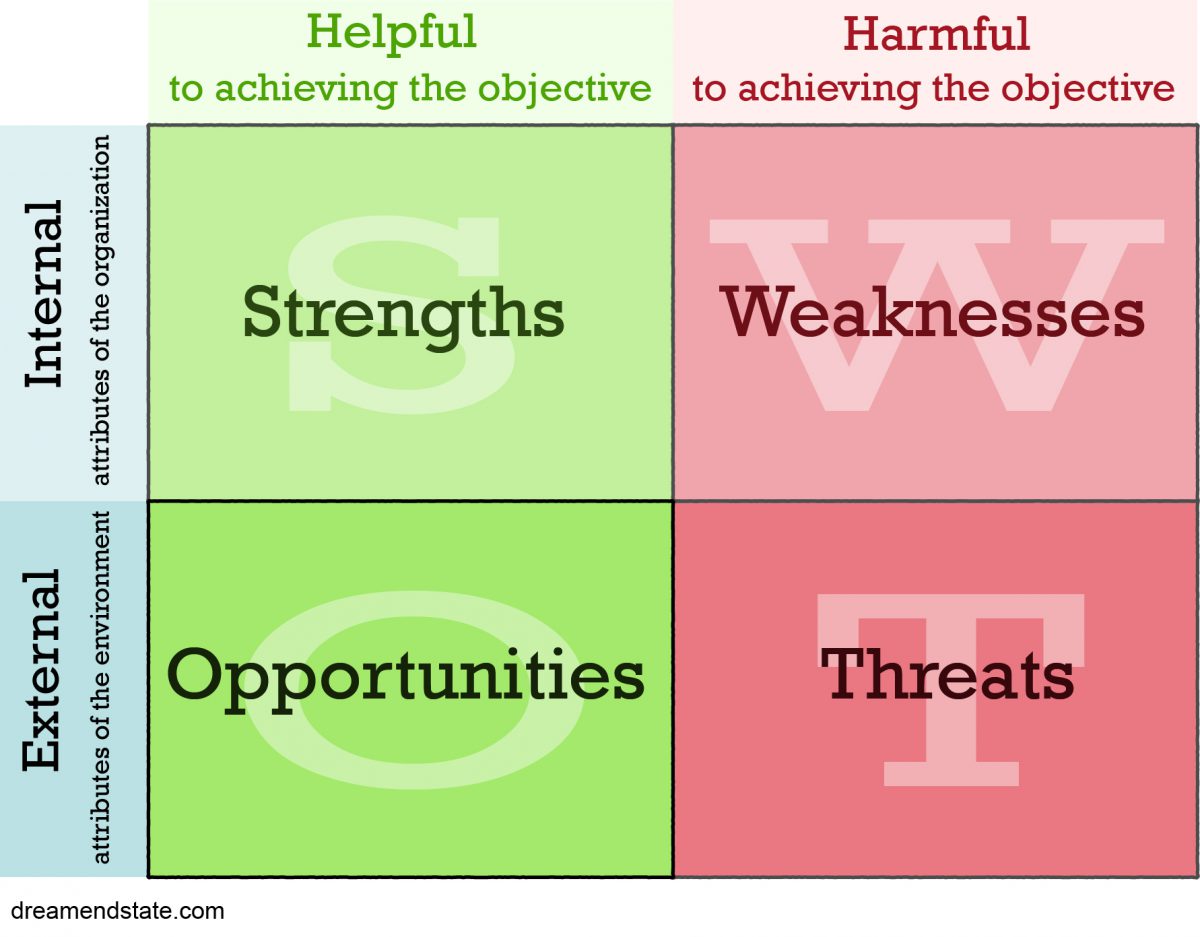

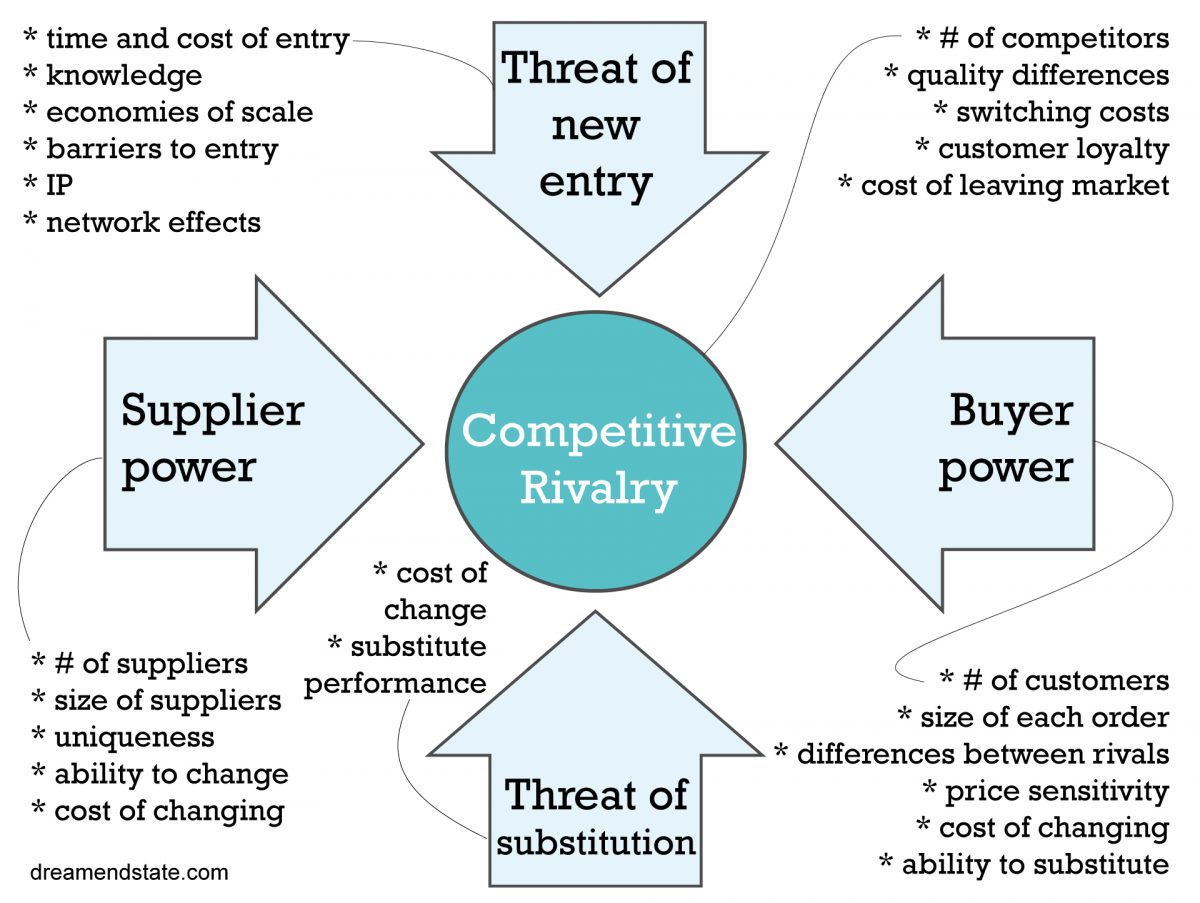

A PESTLE or PESTEL (or formerly, just plain PEST) analysis is a useful tool to deploy when starting a new business or entering a new market. It’s also a powerful sidekick for assessing external factors when used with the more inward facing models, SWOT analysis and Porter’s Five forces, to provide a comprehensive “inside-and-out” perspective on your firm and strategy.

PESTLE stands for:

Political

To what degree does a government intervene in the economy or industry (or with an individual company if it’s nearing or exercising monopoly power)? All influences on your business could be listed here: tax, procurement policy, treaty implementation, trade and environmental policies etc. The government could well be a mixture of negative (eg regulations that constrain) and positive (eg large buyer of health and education services) influences.

Economic

These are the key determinants of an economy’s performance: growth, exchange rates, inflation, interest rates, consumer income, confidence, and unemployment rates. Since all these factors might impact demand and supply in the economy, they all might impact the demand for and cost and supply of your company’s goods and services.

Social

Here you would list out population trends, cultural norms and shifting attitudes (eg be greener and leaner, focus more on experiences than material possessions). These factors are important for marketeers to understand and target their product to customer segments and niches.

Technological

Does new tech threaten or provide an opportunity to your business? Or some combination of the two? This factor refers to the amount of R&D in an industry, technological incentives, and the amount of technological awareness in the market. These factors can influence build or buy decisions, whether to enter certain markets and stop you spending a fortune on technology that may soon become obsolete because of disruption elsewhere.

Legal

Like the political factor but more specifically about the rules and regulations, current and probable-future legal states that provide the rails for your current business or where you might expand. Legal counsel is advised for this sort of thing. A good example would be how the rules and regulations have changed for British companies who sell to or have supply chain in the European Union following Brexit.

Environmental

The emphasis on ESG and particularly the E given global warming means companies, especially large firms, must examine their environmental footprint and try to minimize their environmental impact or risk alienating stakeholders.

Watch out for

Not all factors will be of equal importance to all industries and businesses. Eg a games developer is less concerned about environmental considerations than a utility company.

List out as many factors under each category and rank them in order of importance.

Top tip: try to imagine how this list might change in 6 to 12-months’ time. Don’t just try to observe the here and now but try to foresee upcoming changes, such as disruption in an adjacent industry.

If we’re fairly confident the environment may change, we may reap rewards by adapting now. This explains why some large companies go beyond both the spirit and letter of the law on CSR and ESG. It’s because they can see the tide moving out (eg public opinion on plastic straws) and they don’t want to be standing there with no clothes and their reputation in tatters.

Resources

Kaplan, R. & Norton, D. (January, 2008) Mastering the Management System. Harvard Business Review

Richardson, J. (2019) A Brief Intellectual History of the STEPE Model or Framework (i.e., the Social, Technical, Economic, Political, and Ecological)