Use this model to understand where power lies in a business situation.

Michael Porter’s five forces model is a useful tool to understand and cope with competition. It helps you frame both the strength of your current position and the strength of a position you’re thinking about moving into.

If these forces are intense within an industry, it’s hard for companies to earn attractive returns. In Porter’s 2008 update to his 1979 paper, he lists airlines, textiles, and hotels as being in this camp. If the forces are benign, companies can earn attractive returns – such as software, soft drinks and toiletries, according to Porter.

Understanding the competitive forces, and their underlying causes, reveals the roots of an industry’s current profitability while providing a framework for anticipating and influencing competition (and profitability) over time.

Michael Porter, p.26

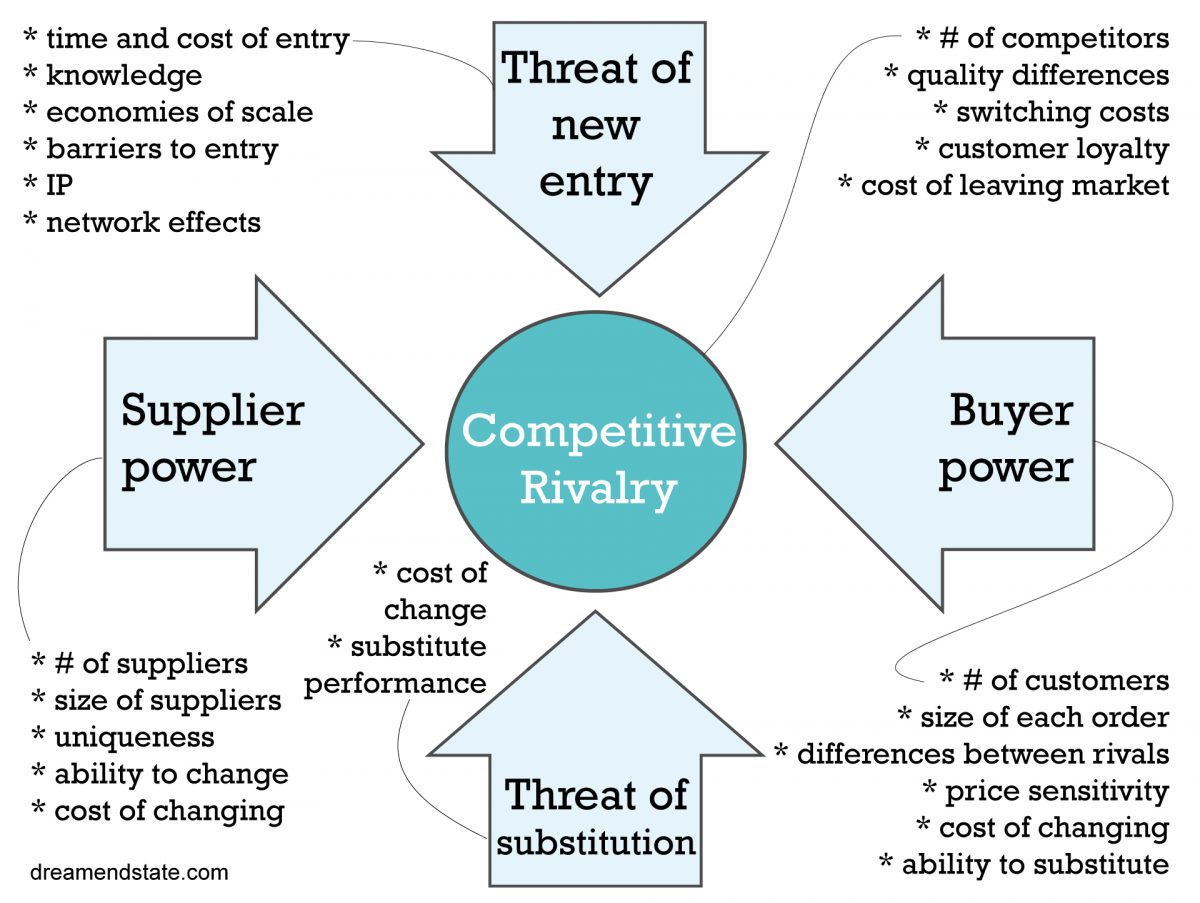

The 5 forces that shape competition

- Threat of new entry. This puts a cap on the profit potential of an industry. If it costs little time or money to enter your market, new competitors can quickly enter your market and weaken your position.

- Supplier power. How easy is it for suppliers to drive up process or limit quality? The fewer suppliers you have the, and the more you need their help, the more powerful your suppliers are.

- Buyer power. On the flip side, powerful buyers can capture more value by driving down prices or asking for more. A few powerful buyers can often dictate terms.

- Competitive rivalry. The number and capability of your competitors will determine how much power you have here. If you provide a homogenous product you will have little power, but if no one can do what you do, you may have tremendous strength.

- Threat of substitution. Easy to overlook, substitutes can take many forms. For example, a consumer might forgo buying a car if there’s a reliable ride hailing service in the area. If substitution is easy and cheap, this weakens your power.

How to use the model

By understanding these forces, you can develop a strategy to improve returns by:

Positioning your business where the forces are weakest. For example, selling high-end electric sports cars.

Exploiting changes in the forces. For example, the emergence of music streaming platforms as broadband speed and smart phone usage increased.

Reshape forces in your favour by using tactics to reduce the share of profits leaking to other payers. For example, expand your services to limit buyer power by making it harder for them to leave for a rival and limit competitive rivalry by producing differentiated products and services.

Watch out for

While the strongest forces determine the profitability of an industry, they are not always easy to identify. Porter gives the example of the photographic film industry. The intense rivalry between Kodak and Fuji was not the factor limiting profitability, rather a better substitute – digital photography. Here, coping with the substitute becomes the top strategic priority.

Porter’s model shows that strategists should not only be concerned with their company’s competitive position versus rivals, but the competitive position of the industry as a whole. For example, consider the impact of Big Tech firms and platformification on traditional media industries such as terrestrial and cable TV, and newspapers.

The model assumes relatively static market structures, which can be a limitation in industries that are moving quickly – such as software development. To make up for this, it’s best to combine Porter’s 5 forces with other strategy models such as SWOT and PESTLE analysis.

Resources

Porter, M. (January 1, 2008). The Five Competitive Forces That Shape Strategy. Harvard Business Review

Porter, M. (1979). How competitive forces shape strategy. Harvard Business Review